If you’re reading this, you’re probably already very familiar with your credit score, but there’s a lot more to it than the good, bad, or somewhere-in-between number that you know.

What is a Credit Score?

Your credit score is a number that reflects your “creditworthiness,” representing the statistical risk a lender takes when they let you borrow money. Simply put, it’s risk management for lenders.

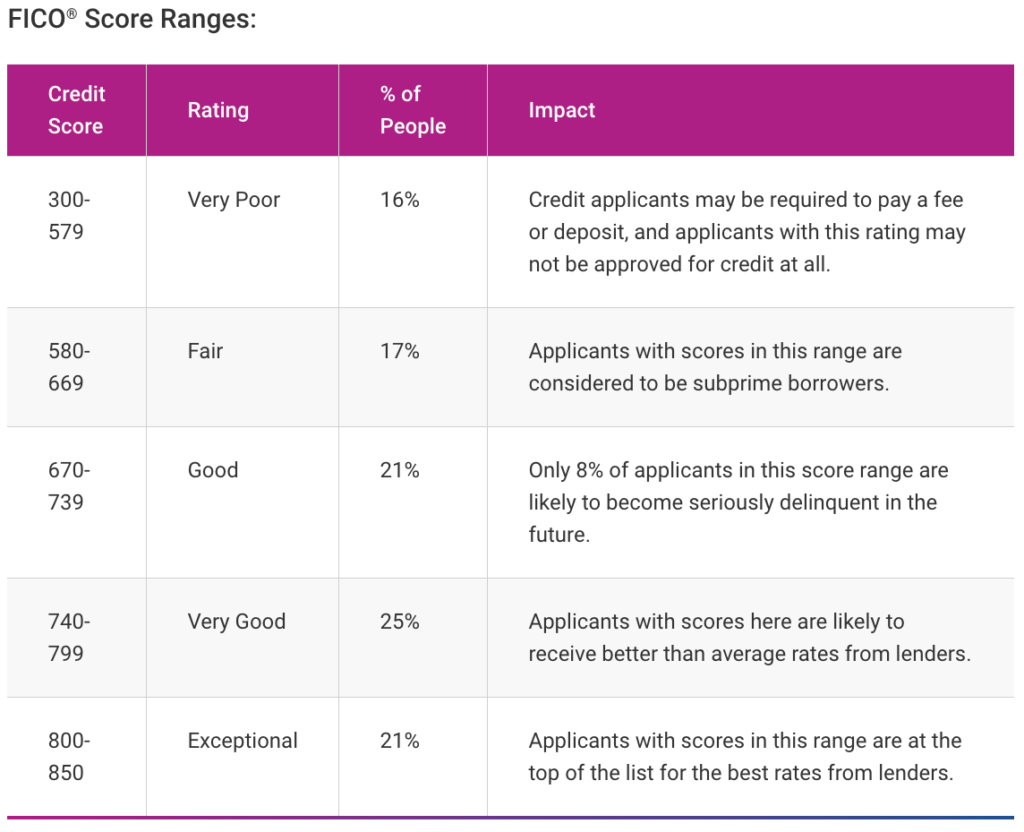

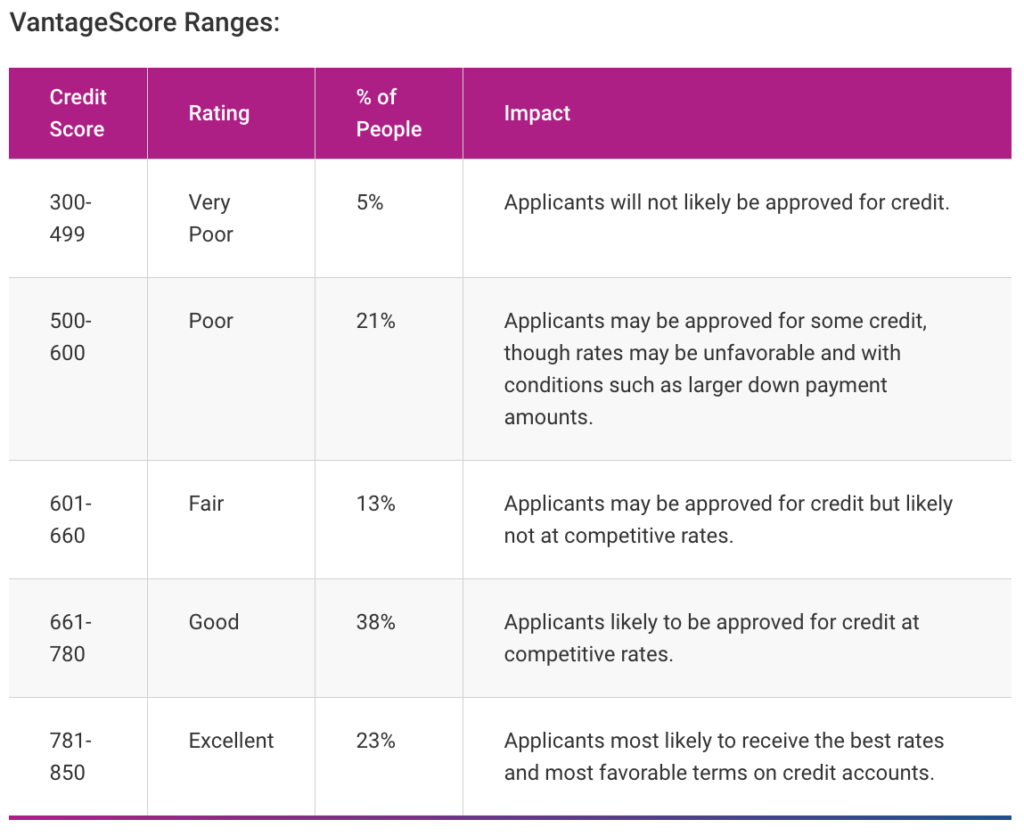

There are two major types of credit scores: FICO and VantageScore.

FICO Score

The Fair Isaac Corporation has provided different types of credit scoring services since way, way back in 1956. In 1981, they created the FICO score to evaluate a credit report and generate a score between 300 and 850. This score is widely used by lenders to determine creditworthiness.

VantageScore

The three major credit bureaus — Equifax, Experian, and TranUnion — together created VantageScore in 2006 to compete with the FICO score. It uses the same scale as FICO: 300-850. Experian, in particular, has thrown its full support behind the collaborative score, even going so far to stop offering a FICO score for its consumers.

You can get your VantageScore with your free credit report at annualcreditreport.com

What is a Good Credit Score?

Though both types of credit scores use the same range of numbers, there are a few differences on how their respective scales are graded. The following information comes from Experian‘s website.

Factors Affecting Your Credit Score

Though your credit score is not included with credit report, your credit score is determined by your credit history. Though the criteria for each scoring model varies, these are the five most common factors that affect your credit score.

Payment History

This is by far the most important factor in determining your credit score. Lenders want to know that you’ll not only pay back your loan, but will do so on time. Even one missed payment can negatively affect your credit score.

Credit Utilization Ratio

This looks at how much credit you’re currently using in relation to what your credit limits are. It helps to show how reliable you are on non-cash funds. Using more than 30% of your available credit will negatively impact your credit score.

Credit Mix

Consumers with good credit will often have a diverse portfolio of credit accounts. FICO and VantageScore look at the different types of accounts and how many total accounts you have to determine past debt experiences and how you’ve handled them.

Hard Inquiries

These are recorded in your credit file each time a lender requests your credit report during their process to decide whether or not to loan money to you. These hard inquiries remain in your credit file for up to two years. The more you have, the more it can negatively affect your credit.

Negative Information

Any negative information indicating that you’ve defaulted on a loan in the past is recorded and can negatively affect your credit score. These include late or missed payments, bankruptcies, foreclosures, collections, and charge-offs.

This was Part 1 of our Credit Report Series. Stay tuned for Part 2.

![The Integrity Difference: Easy Financing & Payment Options [video]](https://www.integrityautofinance.com/wp-content/uploads/2019/02/integrity-difference-easy-financing-payment-options-450x189.jpg)

![Rebuild Your Credit with Integrity [video]](https://www.integrityautofinance.com/wp-content/uploads/2018/12/rebuild-your-credit-with-integrity-450x189.jpg)

![The Integrity Difference: Rebuild Your Credit & Referral Rewards [video]](https://www.integrityautofinance.com/wp-content/uploads/2018/11/integrity-difference-dontay-450x189.jpg)